Mortgage origination fee calculator

On conforming mortgages this fee typically runs somewhere between 750 to 1200. Calculations are based on the current rates which.

First Time Home Buyer Vocab Cheat Sheet With The Top 10 Terms Used During The Home Buying Process First Home Buyer Buying First Home Home Buying

Although borrowers usually pay origination fees they may be able to get their home seller to cover the cost as part of a.

. Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans. An important part of paying for your education through loans is knowing how much youll need and being careful not to overborrow. Loan fees for Federal Direct PLUS Loans are 4228.

Its Never Been A More Affordable Time To Open A Mortgage. Origination fees vary but are often between 05 and 2 percent according to Quicken Loans. On a 150000 home loan with a 1 percent fee you would pay.

Click here for further explanation of what an origination fee is. The cost of a loan to the borrower expressed as a percentage of the loan amount and paid over a specific period of time. Find A Great Lender Today.

The origination fee on a mortgage is typically 05 percent to 1 percent of the amount youre borrowing. Rates are At a 40-year Low. Ad Compare The Best Mortgage Rates.

Avoiding and Lowering a Mortgage Origination Fee. These fees are typically incremented by half-percent. Free personal loan calculator that returns the monthly payment real loan cost and the APR after considering the fee insurance interest of a personal loan.

Origination Charges are just the lender fees for obtaining a loan but there are other fees for obtaining a loan which also show up under Origination Charges on the Loan Estimate and. Origination Fee after 100121 - 4228. Origination Fee Calculator An origination fee is a charge that the borrower pays for taking out the loan.

Top-Rated Mortgages for 2022. On a 300000 house we assume 9261 in closing costs about 34 of the loans value. Check out the webs best free mortgage calculator to save money on your home loan today.

Federal Loan Origination Fee Calculator. As of 2019 the average origination fee for a mortgage for a single. The current loan origination fee rates are.

If you wish to cover the origination fee in your loan amount enter the amount you plan to borrow for the full year and this calculator will calculate the total loan amount needed including the. The Federal Loan Calculator tells you how much money you will receive from your student loan or help you to determine the amount you may need to accept. For many loans a 1 origination fee is common.

The loan disbursement amount is less than the amount you accept in MyMadison or enter on your loan application. Principal 1 r n n - 1 100 1 10 12 12 - 1. Ford Federal Direct Loan Origination Fee Calculators.

Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans. Direct Loan Origination Fee Calculator. Unlike an interest rate the APR factors in charges or fees such as.

Origination Fee before 100121 - 4228. Ad Enter Your Mortgage Details Calculate Your Monthly Payment and Contact Lenders. The most common fee is 1 though the maximum.

Ad Compare the Best Refinancing Mortgage Rates in Just 2 Min. This fee is deducted from the accepted loan amount. Loan fees for Federal Direct Subsidized and Unsubsidized Loans with a first disbursement on or after October 1 2020 are 1057.

Mortgage origination fees are generally 05 to 1 of the value of the loan. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current. Direct PLUS Loan Origination Fees.

An important part of funding your education with loan debt is being aware of how much you need so that you. You will need to take the. Calculate Your Home Loan.

Use this calculator to determine the amount of money that you will either receive from your loan or the amount you need to request after origination. Costs you can shop for amount to about 7600 while fixed costs and fees are estimated to be. Special Pricing Just a Click Away - Get Started Now See For Yourself.

For instance a 400000 home loan could have a fee ranging from 2000 to 4000 fees.

Mortgage Origination Fees What Is It Who Have To Pay It

First Time Home Buyer Lending Vocab Www Abodeagency Net First Time Home Buyers Home Buying Process Vocab

Your Mortgage What To Expect The Initial Document Review Mortgage Mortgage Refinance Calculator Mortgage Approval

Pin On Mortgage Process

Real Estate Vocabulary Originationfee Livelyrealestate Com Livelyagent Realestate Strad Real Estate Client Gifts Real Estate Infographic Real Estate Terms

Acceptable Income And Job History For A Mortgage Loan Approval In Kentucky Buying First Home Real Estate Infographic Real Estate Tips

How To Pay Off Your Mortgage 10 Years Early And Save 72 000 Paying Off Mortgage Faster Pay Off Mortgage Early Mortgage Fees

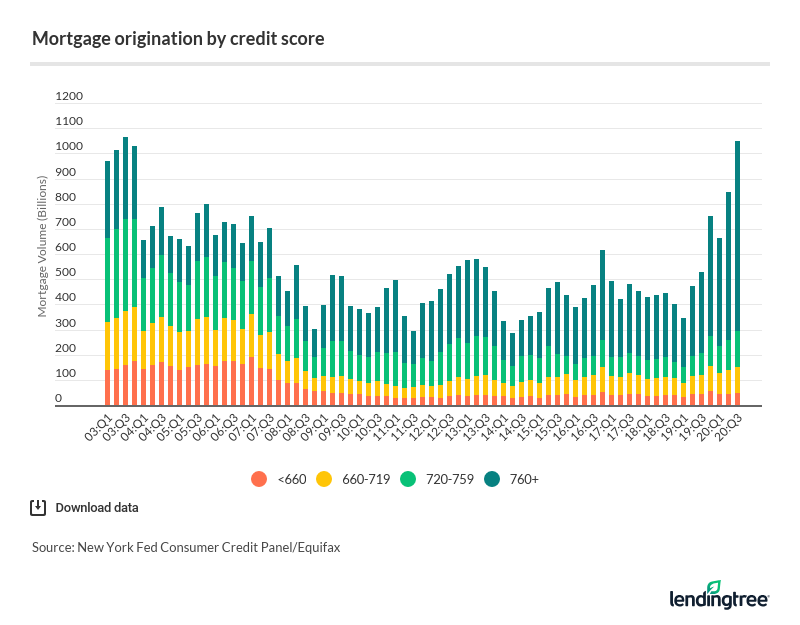

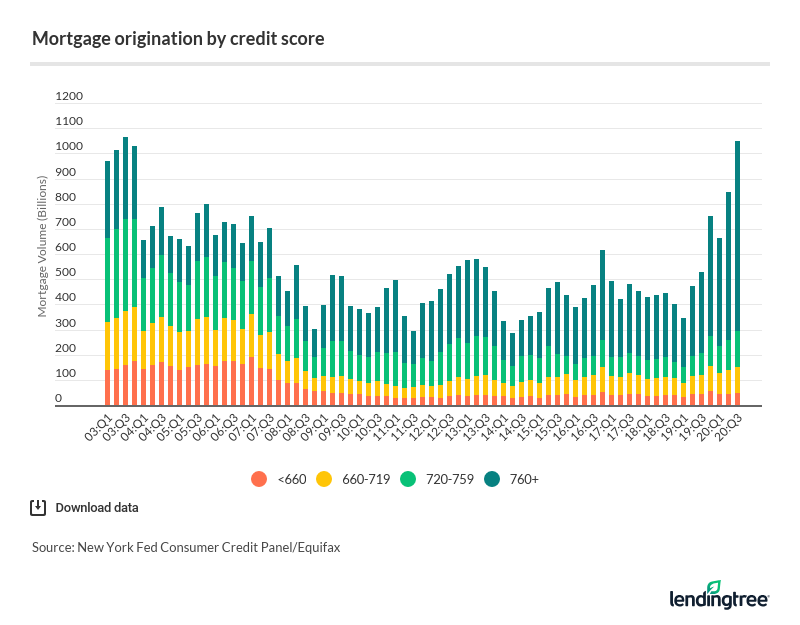

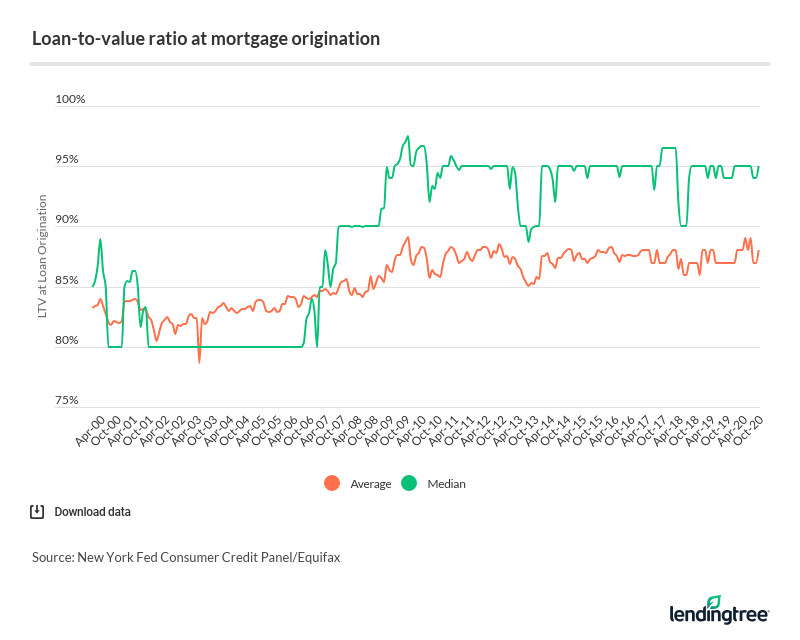

U S Mortgage Market Statistics 2020

The Rising Cost Of Originating Mortgages Let S Stop The Madness

When Will I Know My Final Closing Costs Closing Costs Home Buying Buying A New Home

As A Real Estate Agent I Get Questions From My Clients All The Time About What They Should Ask Their Mo Real Estate Infographic Mortgage Lenders Home Mortgage

Lending Vocab Cheat Sheet Conifer Realty Group Home Mortgage First Time Home Buyers Mortgage Tips

What Is A Loan Estimate How To Read And What To Look For

This Is A Question That Remains Ever Popular Among Home Buyers Closing Costs Are The Fees Associate Real Estate Infographic Buying First Home Real Estate Tips

U S Mortgage Market Statistics 2020

Home Affordability Calculator How Much House Can You Afford Mortgage Payment Calculator Mortgage Loan Calculator Mortgage

Va Loan Tips For Disabled Veterans Va Loan Loan Disabled Veterans