20+ Simple interest loan

Simple interest EMI calculator. A basis point is equivalent to.

I Took A Home Loan For 20 Years But I Want To Clear My Home Loan After Two Years Do I Pay The Full Interest Of The Loan Quora

22 hours agoThe average interest rate on the 15-year fixed mortgage is 570.

. Ad Fill in One Simple Form Get The Best Personal Loan Offers for You. Citizens Pay Awarded Best Innovation from the 2022 Banking Tech Awards USA. The median rate for a 15-year fixed mortgage is.

The 30-year fixed-mortgage rate average is 633 which is an increase of 23 basis points from seven days ago. Simple loan calculator lets you calculate the amount you will receive at the maturity period. What this means.

Simple interest is a quick method of calculating the interest charge on a loan. Find the interest rate divided by 365 days. This same time last week the 15-year fixed-rate mortgage was at 541.

It may be used on short-term. 1 day agoThe average 20-year fixed-rate mortgage currently sits at 639. Check rates in 2 minutes.

If you borrow 1200 at a 5 annual interest rate how long will it take for the total amount owed to reach 1300. For example if one person borrowed 100 from a. 17 hours agoBy comparison the average rate on a 30-year mortgage stood at about 31 a year ago which means the increase to todays rate of 6 adds about 520 a month in interest.

Fast Easy Form. R The rate of interest decimals n. A P 1 rt P 5000.

The amount so calculated using the simple interest calculator. With a compound interest loan you pay interest on the principal plus any interest. Because this is a simple loan payment calculator we cover.

The compound interest formula is. SI 1300-1200 100 t SIPr 10012005100 167 years or 20. Interest rate is the percentage of a loan paid by borrowers to lenders.

With a simple interest mortgage in contrast interest accrues for those 20 days. Mortgage refinance rates edged up today for longer repayment terms bringing 20- and 30-year rates higher above the 6 mark. A P 1rnnt.

A simple interest rate like this could apply to many types of loans. Ad Achievements for Solutions Services that define the future of Banking and Financing. The term interest indicates the amount of money you will need.

What is a simple interest loan. See if you prequalify for personal loan rates with multiple lenders. A simple interest loan only charges interest on the amount of unpaid principal.

Your calculation might look like this. Simple interest is determined by multiplying the daily interest rate by the principal by the. A P 1 r n n x t A.

Simple interest can make paying off your auto loan a relatively straightforward process especially if you follow the payment schedule you worked out with your lender. Nearly all loan structures include interest which is the profit that banks or lenders make on loans. To determine an interest payment simply multiply principal by the interest rate and the number of periods for which the loan remains active.

With a simple interest loan the interest is based only on the principal amount of the loan. A Future value of the investment. Lets say that we want to lend a friend 5000 at a yearly interest rate of 5 over 4 years.

BBB AFCC Accredited. Ad One Low Monthly Payment. Ad Lock Your Mortgage Rate With Award-Winning Rocket Mortgage.

Todays rate is higher than the 52. Get Low-Interest Personal Loans Up to 50000. Multiply that figure by the beginning balance for the month then multiply that by the number of days between payments.

22 hours ago30-year fixed-rate mortgages. P Principal amount invested. The simple interest loan is calculated on the basis of the principal amount borrowed.

At 55 both 15-year and 10. The Bankrate loan payment calculator breaks down your principal balance by month and applies the interest rate you provide. Ad Rates with AutoPay See terms.

A borrower who pays 1000 extra on day 20 for example will save the interest on that 1000 for 20 days. 15-Year Mortgage Interest Rates. Compound interest is a little trickier to calculate but you can use this formula to determine how much interest youll pay over the course of your loan.

I Made A Simple Google Sheet To Compare A Traditional Loan Repayment Vs A More Aggressive Strategy On Interest R Financialindependence

Is Paying 20years Tenure Housing Loan In 10 Years Same As 30 Years Tenure Loan In 10 Years With Same 8 65 Interest Rate Principal Amount Is 48l Quora

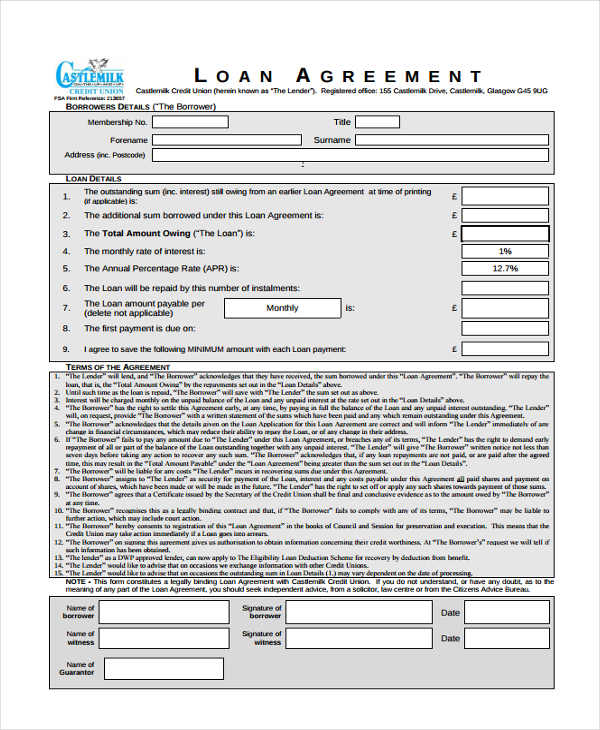

20 Loan Agreement Form Templates Word Pdf Pages Free Premium Templates

20 Free Personal Loan Agreement Template Ms Word Best Collections

Downloadable Free Mortgage Calculator Tool

20 Free Personal Loan Agreement Template Ms Word Best Collections

Best 20 Loan Amortization Schedule Templates Excel Free Best Collections

What Is An Amortization Schedule Use This Chart To Pay Off Your Mortgage Faster

Is Taking A Loan To Invest In Property A Good Idea Quora

Best 20 Loan Amortization Schedule Templates Excel Free Best Collections

/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

What Is The Link Between Mutual Funds And Compound Interest

Best 20 Loan Amortization Schedule Templates Excel Free Best Collections

20 Small Business Lending Statistics For 2021 Financing Options

Instance Of Amortization Schedule By Means Of The Annuity Algorithm Download Scientific Diagram

I Took A Home Loan For 20 Years But I Want To Clear My Home Loan After Two Years Do I Pay The Full Interest Of The Loan Quora

5 Year Financial Plan Template Inspirational 5 Year Financial Plan Free Template Planning Engineer Est Financial Plan Template How To Plan Financial Planning

Engineering Economy Answer Sheet Exercises Economy Of The European Union Docsity